Simplify Global Transactions with Currency Exchange Solutions

Empower your business with a cutting-edge Currency Exchange Solution designed for secure, accurate, and seamless currency conversions. With multi-currency support, real-time exchange rates, and advanced fraud prevention, our solution enables businesses to expand globally while delivering exceptional user experiences.What Problems Does a Currency Exchange Solution Solve?

Limited Access to Currency Conversion

Provides instant access to a wide range of currencies for seamless international currency transfers.

High Conversion Fees

Reduces costs with competitive exchange rates and transparent pricing.

Inconsistent Exchange Rates

Ensures real-time rate updates for accurate and fair currency conversions.

Security Risks

Safeguards user transactions with encryption, KYC, and AML compliance.

Manual Processes

Automates currency exchange operations to minimize errors and increase efficiency.

Customer Dissatisfaction

Enhances user experience with fast, reliable, and secure currency exchanges.

Key Features of a Currency Exchange Solution

A comprehensive currency exchange platform must meet both administrative needs and end-user demands, ensuring security, compliance, and ease of use.

Administrator Features

Real-Time Exchange Rate Management

Automatically update and manage currency rates for accuracy.

Transaction Monitoring

Track and oversee all transactions for compliance and fraud prevention.

Customizable Fees and Margins

Enables flexible fee structures to maximize profitability.

Reporting and Analytics

Gain insights into transaction trends, revenue, and customer behavior.

Multi-Currency Support

Handle transactions across various currencies with ease.

Regulatory Compliance Tools

Automate KYC and AML processes for seamless adherence to regulations.

User Interface Features

Instant Currency Conversion

Enables quick and efficient currency exchanges.

Multi-Language Support

Localize interfaces for diverse user bases around the globe.

Transaction History

Offers detailed records of past transactions for transparency.

Mobile and Web Access

Ensures seamless usability across all devices.

Real-Time Notifications

Alerts users about exchange rate changes and completed transactions.

Secure User Authentication

Protect accounts with advanced login and verification methods.

How Can Businesses Generate Profit from a Currency Exchange Solution?

Transaction Margins

Earn profits by setting margins on real-time currency exchange rates.

Service Fees

Charge a nominal fee for every currency exchange transaction.

Premium Features

Offer enhanced services like personalized exchange rates to high-value clients.

Cross-Border Collaborations

Partner with international banks and payment providers for revenue sharing.

Steps to Start a Currency Exchange Business

Launching a currency exchange solution involves several key steps to ensure smooth implementation and adoption.

Conduct Market Research

Acquire Licenses and Compliance Approvals

Choose a Technology Partner

Develop User-Friendly Platforms

Integrate with Financial Networks

Promote and Launch

Key Requirements for Launching a Currency Exchange Solution

To successfully launch a currency exchange platform, consider these essential requirements

Licenses and Permits

Secure licenses for currency exchange operations in your target regions.

Technological Infrastructure

Set up secure servers, APIs, and real-time rate updating systems.

Regulatory Compliance

Implement robust KYC, AML, and data protection measures.

Banking and Forex Partnerships

Collaborate with financial institutions for liquidity and global reach.

Customer Support Team

Provide responsive support for users to resolve issues effectively.

Marketing and Branding

Develop campaigns to build trust and attract customers to your solution.

Built with Leading-Edge Technology

Appdevs is a leading provider of custom financial software development services, catering to a diverse range of businesses within the banking and finance industry.Front-End

![[object Object]](/_next/static/media/next.cb1d90a5.png)

Next.js

Next.js is a popular React-based framework that enables developers to build fast, scalable, and SEO-friendly web applications.

![[object Object]](/_next/static/media/react.89d58278.png)

React.js

React.js is an open-source JavaScript library for building user interfaces.

![[object Object]](/_next/static/media/vue.b105c8ee.png)

Vue.js

Vue.js is a progressive JavaScript framework used for building user interfaces and single-page applications.

Back-End

![[object Object]](/_next/static/media/laravel.bea31879.png)

Laravel

Laravel is a powerful and elegant PHP framework designed for building modern web applications.

![[object Object]](/_next/static/media/nodeJS.5b61e125.png)

Node js

Node.js is a JavaScript runtime environment. Node.js runs on the V8 JavaScript engine.

![[object Object]](/_next/static/media/python.b96758ee.png)

Django

Django is a high-level, open-source web framework written in Python.

Mobile Apps

![[object Object]](/_next/static/media/flutter.e7f646bb.png)

Flutter

Flutter is an open-source UI software development kit created by Google.

![[object Object]](/_next/static/media/reactNative.e1093344.png)

React Native

React Native is a popular open-source framework for building cross-platform mobile applications.

![[object Object]](/_next/static/media/swift.ea425c9c.png)

Swift

Swift is a high-level general-purpose, multi-paradigm, compiled programming.

DevOps

![[object Object]](/_next/static/media/nginx.76aed3a5.png)

Nginx

Nginx is a high-performance, open-source web server, reverse proxy, and load balancer.

![[object Object]](/_next/static/media/apache.2e47b3bd.png)

Apache

The Apache HTTP Server, commonly referred to as Apache, is a powerful, flexible, and open-source web server.

UI/UX Design

![[object Object]](/_next/static/media/figma.6010ec6b.png)

Figma

Figma is a powerful, cloud-based design and prototyping tool that has revolutionized the way designers collaborate.

![[object Object]](/_next/static/media/adobexd.f65e5df9.png)

Adobe XD

Adobe XD is a user experience and user interface design tool developed by Adobe.

![[object Object]](/_next/static/media/sketch.42dd4a93.png)

Sketch

Sketch is a vector-based design tool primarily used for UI/UX design, web, and mobile application design.

Database

![[object Object]](/_next/static/media/mySQL.284661c9.png)

MySQL

MySQL is an open-source relational database management system.

![[object Object]](/_next/static/media/postgreSQL.79bba237.png)

PostgreSQL

PostgreSQL, also known as Postgres, is a free and open-source relational database.

![[object Object]](/_next/static/media/mongoDB.2bc9137c.png)

MongoDB

MongoDB is a source-available, cross-platform, document-oriented database program.

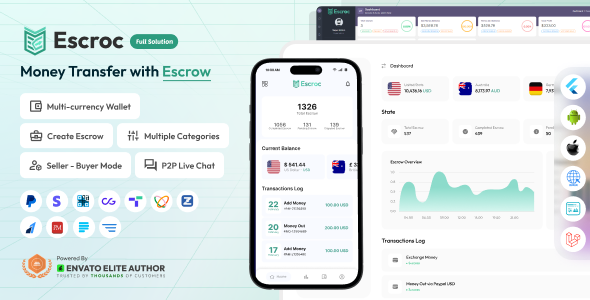

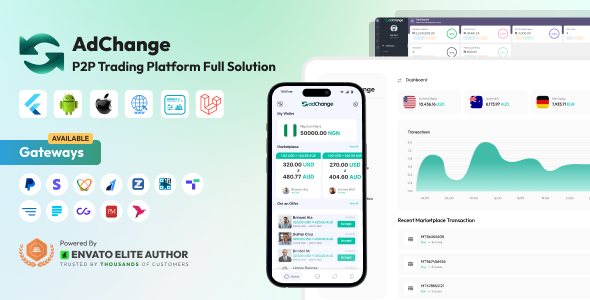

Our Ready-Made Currency Exchange Solutions

Take the first step towards a profitable and future-ready currency exchange business today with our digital payment solutions!

Why Choose AppDevs for Currency Exchange Solution?

Looking to launch your currency exchange platform quickly and efficiently? Our ready-made solutions are designed by industry experts and built for reliability, compliance, and scalability.

Quick Deployment

Our solutions are pre-built and customizable, allowing for rapid deployment to meet market demands.

Cost-Effective

By choosing a ready-made product, businesses can save on development costs and focus their budgets on marketing and scaling.

Scalability

Each solution is designed to scale with your business, whether you’re starting locally or expanding globally.