Transform Your Business with Our Multi-Vendor Solutions

Empower your eCommerce platform with Multi-Vendor Solutions by AppDevs. Our advanced system enables multiple vendors to sell on a unified marketplace, streamlining product management, order processing, and payments. Offer customers a diverse shopping experience while giving vendors complete control over their storefronts—all within a single platform.What Problems Does a Multi-Vendor Solution Solve?

Limited Product Offerings

Expand your marketplace by allowing multiple vendors to list and sell a wide range of products, offering customers more variety.

Manual Vendor Management

Automates vendor registration, product listing, and order processing, saving time for administrators and streamlining operations.

Inefficient Payment Processes

Centralizes payments and integrates a secure payment gateway that handles individual vendor payments automatically.

Lack of Vendor Control

Provides vendors with dedicated dashboards to manage their products, inventory, pricing, and orders independently.

Poor Customer Experience

Enhances the user experience by offering a variety of products from different vendors, all within one easy-to-navigate platform.

Marketplace Scaling Challenges

Simplifies scaling by allowing you to onboard an unlimited number of vendors and manage them from a single admin panel.

Key Features of a Multi-Vendor Solution

A comprehensive multi-vendor platform should serve both administrative and user needs, ensuring security, efficiency, and ease of use.

Administrator Features

Centralized Dashboard

View and manage all vendors, products, orders, and payments from a single platform.

Vendor Management System

Approve or reject vendor applications, set commissions, and track vendor performance.

Product Approval and Moderation

Admins can review and approve products before they are listed on the marketplace, ensuring quality control.

Multi-Language and Multi-Currency Support

Cater to a global audience with support for multiple languages and currencies.

Detailed Reporting and Analytics

Track overall marketplace performance, vendor sales, and customer behavior to optimize business strategies.

Order and Shipping Management

Easily manage order statuses, shipping methods, and vendor shipments through a unified admin interface.

User Interface Features

Vendor Dashboard

Allow vendors to manage their products, track sales, and view customer feedback, all from their own personalized dashboard.

Product Listing and Management

Vendors can add, edit, or remove products and manage stock levels directly from the interface.

Secure Payment Gateway

Integrate payment gateways like PayPal, Stripe, and others to handle secure transactions for each vendor.

Product Search and Filter Options

Enable users to search for products by categories, brands, and prices, enhancing the overall shopping experience.

Customer Reviews and Ratings

Allow customers to rate and review products from vendors, helping others make informed purchasing decisions.

Order Tracking

Provide customers with the ability to track orders in real time from different vendors, improving transparency.

How Can Businesses Generate Profit from a Multi-Vendor Solution?

Commission on Sales

Charge vendors a percentage of each sale they make through the platform, ensuring ongoing revenue.

Subscription Plans for Vendors

Offer subscription plans for vendors to access premium features, enhanced visibility, or priority listing options.

Advertisement Fees

Enable vendors to pay for advertisements to boost their product visibility or place banner ads on the platform.

Transaction Fees

Charge a small fee for each transaction made on the platform, providing a steady revenue stream.

Steps to Start a Multi-Vendor Business

Launching a multi-vendor solution involves several key steps to ensure smooth implementation and adoption.

Identify Your Niche

Choose a Platform

Vendor Onboarding

Set Commission Rates and Payment Methods

Marketing and Promotions

Provide Customer Support

Key Requirements for Launching a Multi-Vendor Solution

To successfully launch a multi-vendor platform, consider these essential requirements

Customizable eCommerce Platform

Choose a platform that allows easy integration of multi-vendor functionality and customization.

Secure Payment Gateway

Implement a reliable and secure payment gateway to handle transactions for multiple vendors.

Scalable Infrastructure

Ensure your hosting infrastructure is scalable to support growing traffic and vendor registrations.

Legal and Compliance Requirements

Draft terms and conditions, privacy policies, and vendor agreements to ensure legal compliance.

Effective Marketing Strategy

Develop an online marketing plan to promote your marketplace to both vendors and customers.

Customer Service Setup

Implement a customer service system to handle disputes, complaints, and feedback from both vendors and customers.

Built with Leading-Edge Technology

Appdevs is a leading provider of custom financial software development services, catering to a diverse range of businesses within the banking and finance industry.Front-End

![[object Object]](/_next/static/media/next.cb1d90a5.png)

Next.js

Next.js is a popular React-based framework that enables developers to build fast, scalable, and SEO-friendly web applications.

![[object Object]](/_next/static/media/react.89d58278.png)

React.js

React.js is an open-source JavaScript library for building user interfaces.

![[object Object]](/_next/static/media/vue.b105c8ee.png)

Vue.js

Vue.js is a progressive JavaScript framework used for building user interfaces and single-page applications.

Back-End

![[object Object]](/_next/static/media/laravel.bea31879.png)

Laravel

Laravel is a powerful and elegant PHP framework designed for building modern web applications.

![[object Object]](/_next/static/media/nodeJS.5b61e125.png)

Node js

Node.js is a JavaScript runtime environment. Node.js runs on the V8 JavaScript engine.

![[object Object]](/_next/static/media/python.b96758ee.png)

Django

Django is a high-level, open-source web framework written in Python.

Mobile Apps

![[object Object]](/_next/static/media/flutter.e7f646bb.png)

Flutter

Flutter is an open-source UI software development kit created by Google.

![[object Object]](/_next/static/media/reactNative.e1093344.png)

React Native

React Native is a popular open-source framework for building cross-platform mobile applications.

![[object Object]](/_next/static/media/swift.ea425c9c.png)

Swift

Swift is a high-level general-purpose, multi-paradigm, compiled programming.

DevOps

![[object Object]](/_next/static/media/nginx.76aed3a5.png)

Nginx

Nginx is a high-performance, open-source web server, reverse proxy, and load balancer.

![[object Object]](/_next/static/media/apache.2e47b3bd.png)

Apache

The Apache HTTP Server, commonly referred to as Apache, is a powerful, flexible, and open-source web server.

UI/UX Design

![[object Object]](/_next/static/media/figma.6010ec6b.png)

Figma

Figma is a powerful, cloud-based design and prototyping tool that has revolutionized the way designers collaborate.

![[object Object]](/_next/static/media/adobexd.f65e5df9.png)

Adobe XD

Adobe XD is a user experience and user interface design tool developed by Adobe.

![[object Object]](/_next/static/media/sketch.42dd4a93.png)

Sketch

Sketch is a vector-based design tool primarily used for UI/UX design, web, and mobile application design.

Database

![[object Object]](/_next/static/media/mySQL.284661c9.png)

MySQL

MySQL is an open-source relational database management system.

![[object Object]](/_next/static/media/postgreSQL.79bba237.png)

PostgreSQL

PostgreSQL, also known as Postgres, is a free and open-source relational database.

![[object Object]](/_next/static/media/mongoDB.2bc9137c.png)

MongoDB

MongoDB is a source-available, cross-platform, document-oriented database program.

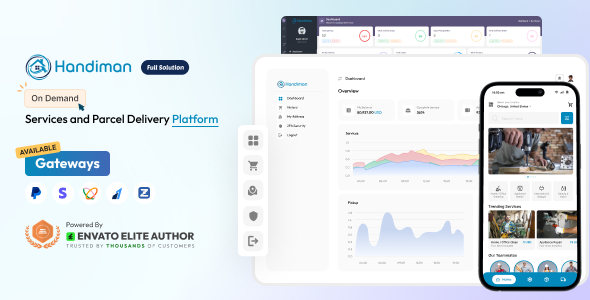

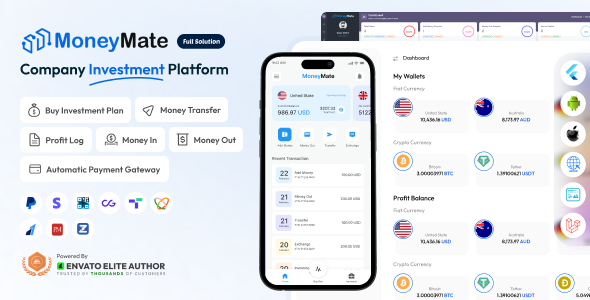

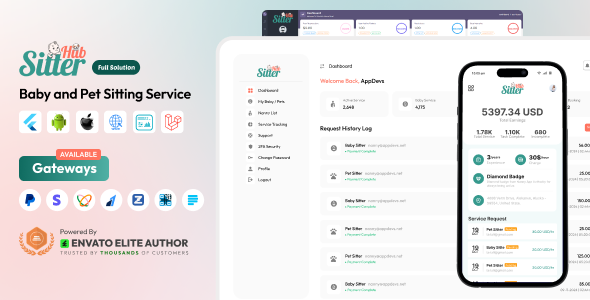

Our Ready-Made Multi-vendor Solutions

For businesses looking for a quick and efficient multi-vendor platform, our pre-built solutions offer a plug-and-play approach with customization options.

Why Choose AppDevs for Multi-Vendor Solutions?

Our ready-made solutions are built by industry experts with years of experience, ensuring a reliable and professional product. Our solutions are designed to meet industry standards and exceed your expectations by leveraging proven methodologies and advanced technologies.

Quick Deployment

Our solutions are pre-built and customizable, allowing for rapid deployment to meet market demands.

Cost-Effective

By choosing a ready-made product, businesses can save on development costs and focus their budgets on marketing and scaling.

Scalability

Each solution is designed to scale with your business, whether you’re starting locally or expanding globally.