A Comprehensive Guide to Mobile Banking Solutions

This guide explores the fundamentals of mobile banking solutions, including their key features, the problems they solve, profitability strategies for banks and entrepreneurs, and the necessary steps for launching a mobile banking platform.What Problems Does a Mobile Banking Solution Solve?

Limited Access to Banking Services

Traditional banking can be inconvenient, especially for individuals in remote locations or those with busy schedules. Mobile banking solutions bridge this gap by providing seamless digital banking access from anywhere.

High Operating Costs

Physical bank branches require substantial investments in staff, infrastructure, and maintenance. A mobile banking system significantly reduces these costs while increasing efficiency.

Enhanced Customer Engagement

A well-designed banking app improves user satisfaction by offering on-demand access to financial services, real-time notifications, and personalized banking experiences.

Security Concerns

With increasing cyber threats, mobile banking applications incorporate robust security features such as multi-factor authentication, biometric verification, and encrypted transactions to protect user data.

Transaction Inefficiencies

Manual banking processes lead to errors and delays. By digitizing operations, mobile banking software automates transactions, reduces processing time, and enhances accuracy.

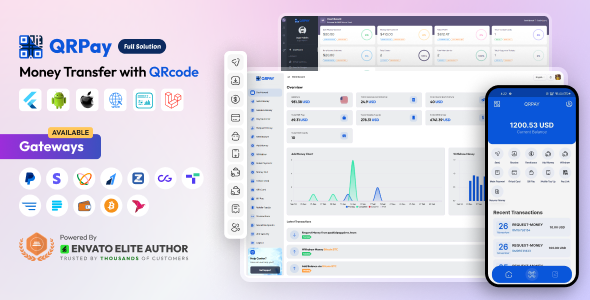

Key Features of a Mobile Banking Solution

A complete mobile banking system should cater to bank administrators and end-users, ensuring seamless financial management and enhanced digital payment solutions.

For Bank Administrators

User Management

Tools to manage user access, roles, and data securely.

Real-Time Transaction Monitoring

Systems for tracking transactions as they occur, ensuring compliance and enabling rapid response to any irregularities.

Reporting and Analytics

Generate insights into transaction volumes, customer behavior, and performance metrics to guide data-driven decision-making.

Integration Capabilities

Seamlessly integrate with existing bank systems and third-party services for flexibility and ease of adoption.

For End Users

Account Overview

Allows users to view balances, transaction history, and account details in a single dashboard.

Fund Transfers

Secure fund transfers to other accounts, both within the same bank and to external institutions.

Bill Payment Services

Pay utility bills, loans, and subscriptions directly through the banking app.

Digital Wallet and Virtual Card Access

Offers a secure digital wallet and virtual cards, enhancing convenience and security for online transactions.

QR Code Payments

Quick, contactless payment options through QR codes, ideal for retail and merchant transactions.

How Can Businesses Generate Profit from a Mobile Banking Solution?

Transaction Fees

Banks generate revenue by charging minimal fees on money transfers, bill payments, and mobile payment transactions.

Subscription Plans

Offer tiered plans, where basic services are free, but premium features—such as higher transfer limits, advanced analytics, or exclusive financial products—are available through a subscription model.

In-App Advertising

Partner with brands and financial institutions to display targeted ads within the mobile banking app, creating an additional income stream.

Merchant Partnerships

Earn commissions from merchant transactions by enabling seamless QR code payments and digital wallet services for retail and e-commerce platforms.

Steps to Start a Mobile Banking Business

Launching a mobile banking solution involves several key steps to ensure smooth implementation and adoption.

Service Scope

Features and Packages

Brand Customization

Integration and Setup

Training Deployment

Launch and Market

Requirements for Launching a Mobile Banking Solution

To successfully launch a mobile banking platform, consider these essential requirements

Regulatory Compliance

Obtain necessary licenses and ensure that your operations align with regional and global regulatory standards in the financial sector.

Robust Security Measures

Implement strong data protection protocols, such as encryption and multi-factor authentication, to safeguard user information and transactions.

Cross-Platform Compatibility

Ensure that the app is compatible with both iOS and Android devices, providing a smooth experience across devices.

Customer Support Infrastructure

Establish a reliable support team to assist users with any issues and answer questions, maintaining high levels of customer satisfaction.

Technical Setup and Maintenance

Prepare your IT team for managing, monitoring, and maintaining the app after launch, ensuring system stability and performance.

Marketing Strategy

Develop a plan for user acquisition, including a budget for digital marketing, partnerships, or incentives to attract users.

Built with Leading-Edge Technology

Appdevs is a leading provider of custom financial software development services, catering to a diverse range of businesses within the banking and finance industry.Front-End

![[object Object]](/_next/static/media/next.cb1d90a5.png)

Next.js

Next.js is a popular React-based framework that enables developers to build fast, scalable, and SEO-friendly web applications.

![[object Object]](/_next/static/media/react.89d58278.png)

React.js

React.js is an open-source JavaScript library for building user interfaces.

![[object Object]](/_next/static/media/vue.b105c8ee.png)

Vue.js

Vue.js is a progressive JavaScript framework used for building user interfaces and single-page applications.

Back-End

![[object Object]](/_next/static/media/laravel.bea31879.png)

Laravel

Laravel is a powerful and elegant PHP framework designed for building modern web applications.

![[object Object]](/_next/static/media/nodeJS.5b61e125.png)

Node js

Node.js is a JavaScript runtime environment. Node.js runs on the V8 JavaScript engine.

![[object Object]](/_next/static/media/python.b96758ee.png)

Django

Django is a high-level, open-source web framework written in Python.

Mobile Apps

![[object Object]](/_next/static/media/flutter.e7f646bb.png)

Flutter

Flutter is an open-source UI software development kit created by Google.

![[object Object]](/_next/static/media/reactNative.e1093344.png)

React Native

React Native is a popular open-source framework for building cross-platform mobile applications.

![[object Object]](/_next/static/media/swift.ea425c9c.png)

Swift

Swift is a high-level general-purpose, multi-paradigm, compiled programming.

DevOps

![[object Object]](/_next/static/media/nginx.76aed3a5.png)

Nginx

Nginx is a high-performance, open-source web server, reverse proxy, and load balancer.

![[object Object]](/_next/static/media/apache.2e47b3bd.png)

Apache

The Apache HTTP Server, commonly referred to as Apache, is a powerful, flexible, and open-source web server.

UI/UX Design

![[object Object]](/_next/static/media/figma.6010ec6b.png)

Figma

Figma is a powerful, cloud-based design and prototyping tool that has revolutionized the way designers collaborate.

![[object Object]](/_next/static/media/adobexd.f65e5df9.png)

Adobe XD

Adobe XD is a user experience and user interface design tool developed by Adobe.

![[object Object]](/_next/static/media/sketch.42dd4a93.png)

Sketch

Sketch is a vector-based design tool primarily used for UI/UX design, web, and mobile application design.

Database

![[object Object]](/_next/static/media/mySQL.284661c9.png)

MySQL

MySQL is an open-source relational database management system.

![[object Object]](/_next/static/media/postgreSQL.79bba237.png)

PostgreSQL

PostgreSQL, also known as Postgres, is a free and open-source relational database.

![[object Object]](/_next/static/media/mongoDB.2bc9137c.png)

MongoDB

MongoDB is a source-available, cross-platform, document-oriented database program.

Our Ready-Made Mobile Banking Solutions

This is for businesses looking for a fast and affordable launch, our ready-made mobile banking software provides a secure and customizable solution with proven reliability in the industry.

Why Choose AppDevs for Mobile Banking Solutions?

Our ready-made solutions are built by industry experts with years of experience, ensuring a reliable and professional product. Our solutions are designed to meet industry standards and exceed your expectations by leveraging proven methodologies and advanced technologies.

Quick Deployment

Our solutions are pre-built and customizable, allowing for rapid deployment to meet market demands.

Cost-Effective

By choosing a ready-made product, businesses can save on development costs and focus their budgets on marketing and scaling.

Scalability

Each solution is designed to scale with your business, whether you’re starting locally or expanding globally.