- Home

- Solutions

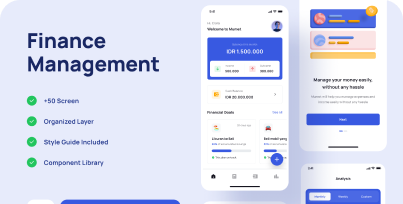

Digital Mobile Banking Solution

Seamless banking on-the-go with secure transactions and features.

Cross-Border Remittance Solutions

Fast and affordable international money transfers made easy.

E-Wallet Solution

Secure digital wallet for effortless payments and fund management.

Payment Gateway Solution

Reliable payment processing for online transactions and businesses.

Currency Exchange Solution

Real-time currency conversion for global transactions at competitive rates.

Branded Card Issuing Solution

Custom card solutions tailored for businesses and brands.

Crowdfunding Solution

Effective platform for raising funds and supporting projects with ease.

Investment Management Solution

Comprehensive tools for effective portfolio management and growth.

Online Escrow Solution

Secure transactions with trusted escrow services for peace of mind.

AI Chatbot Solution

Intelligent chatbot solutions for enhanced customer service and engagement.

Automated Booking Solution

Streamlined booking system for appointments and reservations.

Multi-vendor

Flexible platform for multiple sellers to showcase and sell products.

View All

View AllCustom Fintech Solutions

WowStore is the complete WooCommerce solution, featuring a wide library

- Services

Installation & Deployment

Smooth installation and deployment for seamless FinTech system integration.

Custom FinTech Development

Tailored FinTech software to streamline financial operations and innovation.

DevOps Services

Efficient DevOps solutions for faster, reliable software delivery.

Cloud Services

Scalable cloud infrastructure for enhanced performance and security.

Maintenance and Support

Reliable maintenance to keep FinTech systems running smoothly.

Mobile App Development

Advanced mobile solutions crafted for the finance industry.

Quality Assurance Testing

Comprehensive testing to ensure high-performance, reliable software.

UI/UX Design

User-focused design for engaging, efficient FinTech applications.

Web Development

Robust web solutions tailored for FinTech businesses.

View All

View AllCustom Fintech Solutions

WowStore is the complete WooCommerce solution, featuring a wide library

- Products

- Blog

- Company

About Us

Your Trusted Development Partner

Our Mission

Committed to Innovative Solutions

Our Vision

Shaping the Future of Technology

Join Our Team

Careers at AppDevs

Life at AppDevs

Discover Our Company Culture

FAQs

Get Answers to Your Questions About AppDevs

Custom Fintech Solutions

WowStore is the complete WooCommerce solution, featuring a wide library

- Help

Documentation

Access comprehensive guides and resources for seamless product usage.

Sales Support

Connect with sales for purchase inquiries and product details.

Technical Support

Get help with technical issues and troubleshooting guidance.

Get Customization

Request tailored solutions to fit your unique business needs.

Talk to Expert

Schedule a consultation with our experts for in-depth assistance.

Custom Fintech Solutions

WowStore is the complete WooCommerce solution, featuring a wide library